jillio

New Member

- Joined

- Jun 14, 2006

- Messages

- 60,232

- Reaction score

- 22

It could be that Maria is a clairvoyant?

Or delusional. Even Nostradamus was able to give solid reasons for his predictions. Maria appears to have none.

It could be that Maria is a clairvoyant?

That's a pretty reasonable assessment of what would happen if he were to follow through on his capital gains tax hike right away. However, the problem is you're assuming he'll immediately follow through on his promises. For one, he has backed off his 28% plan and said it might be as low as 20%. Additionally, he recently signaled that he's willing to back off his promise to repeal the Bush tax cuts and let them expire in 2011 instead (Rather than repeal tax cuts for rich, Obama may simply let them expire in 2 years). I imagine he would postpone raising capital gains taxes as well. I think he's smart enough to know that now is not a good time to raise taxes and he doesn't want to go down in history as making the financial crisis even worse. I can only pray that I turn out to be right.He will screw up economy because, he will double the capital gains tax rate. This could trigger a sell-off in both the stock market and real estate market between election day and the first of the year.

Or delusional. Even Nostradamus was able to give solid reasons for his predictions. Maria appears to have none.

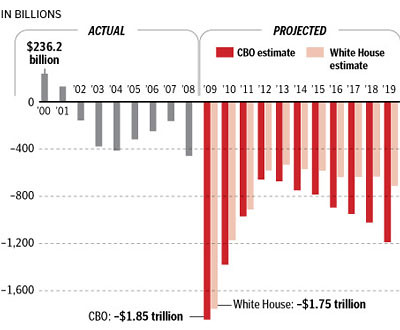

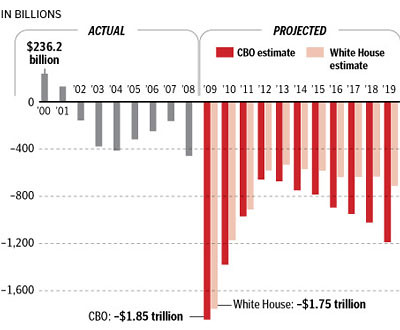

Pretty darned closed. With a deficit projection of $1.8 trillion (or more) this year I'd say that's a good way to ruin the economy eventually when you spend money you don't have and hav no way of paying it back. And this deficit is 5 times bigger than Bush's deficit in his first year in office. Spending money on what you don't have is not how you address debts. Increase in taxation will not work. Even if you tax 100% on the "rich" it still would NOT cover the budgeted amount for the fiscal year which is more than 2 trillion dollars. Besides, the top 25% income earners pay 86% of all federal income taxes.

http://www.cbo.gov/doc.cfm?index=10014&type=1

Ya'll just happened to inherit the most-naive president in U.S. history.

Did you even read the document you linked? It wouldn't appear that you did.

And please cite your source for your percentages on income earners and federal taxes.

Income earners...

http://www.irs.gov/pub/irs-soi/05in05tr.xls

Taxes and Income - WSJ.com

Top 25% income earners paid 86% of all taxes. See Table 1.

The Tax Foundation - Summary of Latest Federal Individual Income Tax Data

Yes, I read the document. Those were projected proposals back in March 2009. Did you even look? Page 11.

Annual Federal budget has been around $3 trillion dollars over the last few years with a 2010 request for an astounding $3.4 trillion dollars on top of the $1.1 trillion dollars or so for next year's deficit estimate.

During Fiscal Year (FY) 2006, the IRS collected more than $2.2 trillion in tax net of refunds, about 44 percent of which was attributable to the individual income tax. And even if you tax 100% the top 5% income earners which was a shade under $3 trillion dollars (2006 FY) it wouldn't come anywhere near close to helping the deficit!! So, what to do? Devise a different way to tax companies and that is the Cap and Trade program to help regulate CO2 which, laughingly, that the EPA has declared it to be a pollutant. It is not. We breathe it. Plants thrive on CO2. Man has not caused global warming. We're insignificant little specks on earth to exert that kind of control. But back to the subject, how will we pay for Obama's massive, massive out of control spending incurring larger and larger deficit. In 100 days he managed to incur a deficit of $1.8 trillion dollars which was several times bigger than Bush's deficit spending in his first year in office. Again, maxing out on your credit cards isn't a solution to solve your debt problem. And expanding and introducing more new programs which cost hundreds of billions of dollar more isn't the answer either. Knocking of 17 billion dollars out of $1.8 trillion is like you sacraficing $250 out of your $50,000 a year income. Doesn't do any good.

Again, we have the most naive president in presidential history.

And now you know the rest of the story.

You have again either failed to read the information on these sites, or failed to comprehend that which you read. Don't know which it is.

No. I understand. It is a fact that there would be a $1.8 trillion dollar deficit on Obama's behalf (based on CBO's predictions for this year's deficit amount) which could go a hundred billion more or less in either direction by the end of this year. I pointed out the page to the CBO's tables on their deficit predictions for this year. You have a problem with that or what?

it is a FACT that the top 25% of income earners paid 86% of the federal income tax (based on 2006 returns). Again, see table that says "Total Income Tax Share" - The Tax Foundation - Summary of Latest Federal Individual Income Tax Data. Heck, even the top 1% (the "rich" or those making more than $388,000 in 2006) income earners paid almost 40% of the Federal income tax in 2006.

It is a FACT that if you try and tax 100% on the rich (top 1%) it won't even work to even pay all of the more than $3 trillion budgeted amount. In fact, it'll be much less than $3 trillion dollars collected if they area taxed 100%.

The Tax Foundation - Summary of Latest Federal Individual Income Tax Data

I provided the links to these facts and sources for my numbers. It's there. Read it next time.

Which ones I presented are incorrect? The income tax earners? Obama's trillion dollar deficit for FY 2009? I'm curious to know if you can in fact point them out and provide an alternative but official link that says otherwise. Or at least be MORE specific in which ones you think it's wrong. You say I haven't read these links (many of these were book marked over the last few years and I use them as my sources in many discussions) which is funny. I'm just guessing that you're into overdrive defense mode. I could be wrong but it sure looks like it.

But will Obama's deficit get into the trillion (if not by then 2 trillion dollars by the end of year we'll have wait and see) for FY2009? Is it not true that the top 25% income earners paid more than 86% of the Federal income tax in 2006 and that group pay the big chunk of the taxes compared to 1% top earners paying almost 40% (I'm sure it's at 40% right now) in 2006. And are you saying that it is possible to tax the rich (top 1%) at 100% and they would be able to pay off the annual budgeted amount for the Federal govt?

You are still failing to recognize simple logic. Of course top income earners pay the majority of taxes. That is exactly the way the income tax system is supposed to work. That is why it is based on income, and not a set rate.:roll:

You are referring to which "simple logic"? Now, all of a sudden you're spouting just words with no meanings or specificity. Did you read the links at all? Are you actually disagreeing that the deficit isn't projected to be $1.8 trillion dollars this year? What?

I provided a link to CBO's estimates on projected deficit for this year (and next) on page 11. Look again on page 11 of the CBO report I am specifically referring to on the projected deficit for this year, which is again at $1.8 trillion dollars.

http://www.cbo.gov/ftpdocs/100xx/doc10014/03-20-PresidentBudget.pdf

And, lo and behold! Jake Tapper on ABC News finally reports today this CBO's report (that I just linked a few days ago here), published in March of 2009, two months later.

Deficit Now Projected at $1.8 Trillion for 2009 - Political Punch

Maybe you might want to object to ABCnews report on the $1.8 trillion dollar deficit, too?

Top income earners? Which ones? The top 1%? 5%, 10%, or 25%? I am assuming you meant the top 1%.

Now, as I have stated before, even if you tax the top 1% of income earners with a 100% tax it wouldn't be enough to pay all of this year's budgeted amount for the Federal govt and their programs. Since by doing doing so you'd only collect just barely a trillion dollars. Taxes collected on individual income makes up 45% of the money that goes to the Federal govt as their source of "revenue." So, "taxing the rich" isn't the solution but a dangerous game to play on our economy by reducing incentives to invest and run companies here in the United States. Taxing 100% on the top 5 or even 10% income earners won't come close to help fund the required $3.1 trillion dollars (for 2009 or even 2010 at $3.4 trillion) needed for on increasing govt programs.

You asked for links and references to my claims, which are facts anyways, and you got 'em. Which ones are you disagreeing with now? What's your real complaint in all this? Or is this merely a defense mechanism you're not realizing?

Yes, he's the naive one thinking the solution to solving a national debt problem is to spend and borrow more money than ever before in presidential history that easily put Bush (and many other presidents before him) to shame on deficit spending by 4 to 5 times as much. This is just as logical as to max out your credit cards thinking it'll help solve your own debt problems. Please, come at me with this logic thing again.

Yes.

Fox News is NOT a good source.

Yes, I read the links. Perhaps you should as well. A bit of history and sociology wouldn't hurt you, either.

Not gonna bite, Jillio. This is your classic M.O. on how your respond to these things with one liners that begin with "You should...". I've noticed it. So have other people here. Either you come up with a specific rebuttal to shore up your argument or a way to counter mine then that's fine. But when it comes to debating you have obviously failed in that regard. You're never clear on any rebuttal attempt other than using your own patented bob and weave response which is a classic example of an anti-intellectualism exercise. I provided the facts with the links. Being purposefully intellectually dishonest is not how you debate. It's quite disheartening to see you avoid any discourse regarding Obama's $1.8 trillion dollar deficit (a fact) that already has the real possibility of tearing down America. I provided the links, the sources, I have read them. You have not answered my questions on which ones I provided were incorrect. I do not have the capability of reading your mind, however. Just don't insult my intelligence, woman. A discourse, fine. But to avoid it through one liners while exercising your own brand of anti-intellectualism makes you rather transparent here. I'm not easily fooled. Others, sure. But I rather debate on the merit of facts and honest opinions, even if it's a biased one. They all are anyways. If you don't have the balls to be honest about Obama's deficit or answer my questions then it'd be better for you not to say a word in the first place. Being overly defensive over Obama's mishandling of our nation's money is not an excuse to play dumb.

Does it ever occur to you that we don't care about you? Insulting our president and calling people "liberals" don't help your cause whatsoever.

Go kiss Limbaugh's ass for all I care. The more GOP kisses Limbaugh, the more GOP loses its credibilty.

No, you provided links and a gross misinterpretation of the information contained in those links.

That's not how a debate work. It's not even a proper rebuttal either. Are you a teacher or what?

Try again. Jillio. And don't play dumb, either. Explain how it was misinterpreted. If you make the claim that it was gross misinterpretation then the onus is on you to show how. You have not answered my questions, either.

Then it shouldn't be too hard to specify how he misinterpreted. I mean, even Forrest Gump is capable of repeatedly saying "Jennaaaay, you've grossly misinterpreteeeeeeed".No, you provided links and a gross misinterpretation of the information contained in those links.

Then it shouldn't be too hard to specify how he misinterpreted. I mean, even Forrest Gump is capable of repeatedly saying "Jennaaaay, you've grossly misinterpreteeeeeeed".

But then, I don't envy those in a position to defend the red after having screamed so loudly about the gray.

Projected Deficit - washingtonpost.com

So, your screaming at Bush over his some $360 billion dollar deficit demanding how we are going to pay for that and yet you and others ignore Obama's $1.8 trillion dollar deficit for this year which is 4 to 5 time bigger than Bush?

Ok.

I'm for limited govt, lower taxes, capitalism, regulation of business and investing, a strong national defense, and individual financial responsibility and accountability. This is what Rush believes in as well. I suppose you are against every one of those then?

Oh pleeeeease... Rush believes in getting coked to the gills as well. What's so credible about that?