Luck had nothing to do with it. Stuffing money away in a 401k and hoping in is managed properly is not exactly "planning". That is what both of us are saying. If you are going to put money at risk you better stay on top of it, it's that simple. Otherwise, it is like throwing money on a hand of blackjack and leaving before the cards are dealt hoping they will track you down at the buffet when you win.

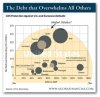

That is exactly right. You cannot just spend 30 minutes a day on it. It's more like several full days per week. You have to know what industries are on the upswing and which ones are on the way down; you have to know where you are in the bull/bear market cycle. You also have to know long-range the political climate and how that affects the business environment, especially with respect to hostile governments. You then have to know how your currencies in those countries affect your return on investment vis-a-vis your national currency. I haven't even added in that there are many kinds of businesses to invest in, like your blue stocks on the DOW, your juniors, your explorers in the mining industry, and disruptive technologies industries - here you really have to do your research, like meet the managers and owners of the business, do background checks on them, credit reports, business history, references, everything about that business before you get involved, otherwise, it's money down a rat-hole.

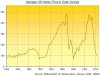

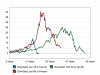

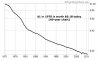

Now, as for the charge against me regarding the gold-annual-increase report - so what if they are promoting gold? The FACT IS, gold has gone up every year, and it's clear, because of the average person's background in sound money, that you do not understand the context in which we find ourselves in today. That is, we are nearing the end of an experiment in fiat currency, which is about 40 years as of this past August. Generally, experiments in fiat currency last about that LONG, about a generation, before the next generation finally realizes what has happened to them, and then there's the flight back to gold, silver, or at least something tangible EVERY TIME IN HISTORY. Read it. Without precious metals as a way to restrain the tendency to print money at will, what has happened, happens. Every single time.

I can do a source dump here for you if you like. It's about six years of research that I did FULL TIME. Some weeks, it was seven days a week, all day long. I learned to trust certain people, and the rest fell by the wayside.

By the way,

Gold Anti-Trust Action Committee | Exposing the long-term manipulation of the gold market was the source for the gold report I referred to. They have documented what is going on with gold, silver, the Federal Reserve System, etc. for the last 11 years. You will find links to news articles, government documents like those at the US Treasury Department, and documents at the Federal Reserve System as well. These are all available as a matter of public record. This is not a conspiracy. It is all there if you are willing to look and know where to look.

The reason I point to gold and silver in this thread is because there is a better return on your money than you will find in the DOW in general, AT THIS TIME. During the 80s-90s, it was not, and there's a whole stack of reasons why. However, in case you are wondering what sound money is, how something that is unbacked by something untangible affects your REAL WEALTH. Did you look at any of the charts I provided? Some people have many multiples of what they originally paid for their metals, even at a post-CME-margin-crash level of $32 this past May. Have you looked at a DOW chart going back to 2000?